2024 Asia Meeting, South/Central/West, Delhi, India: January, 2024

Distributional Consequences of Monetary Policy: A Continuous Time Heterogeneous Agent Model for India

Suranjana Kundu

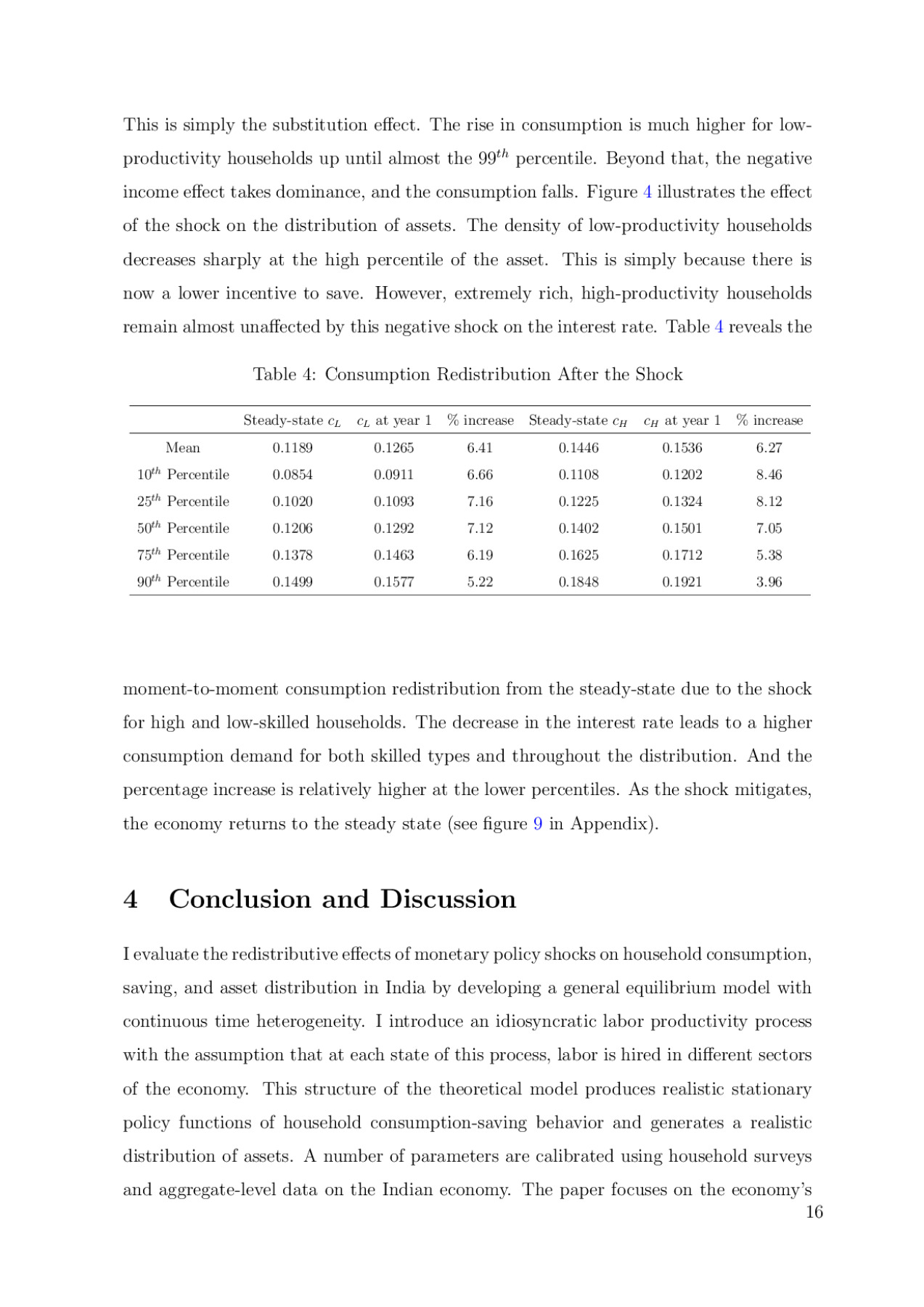

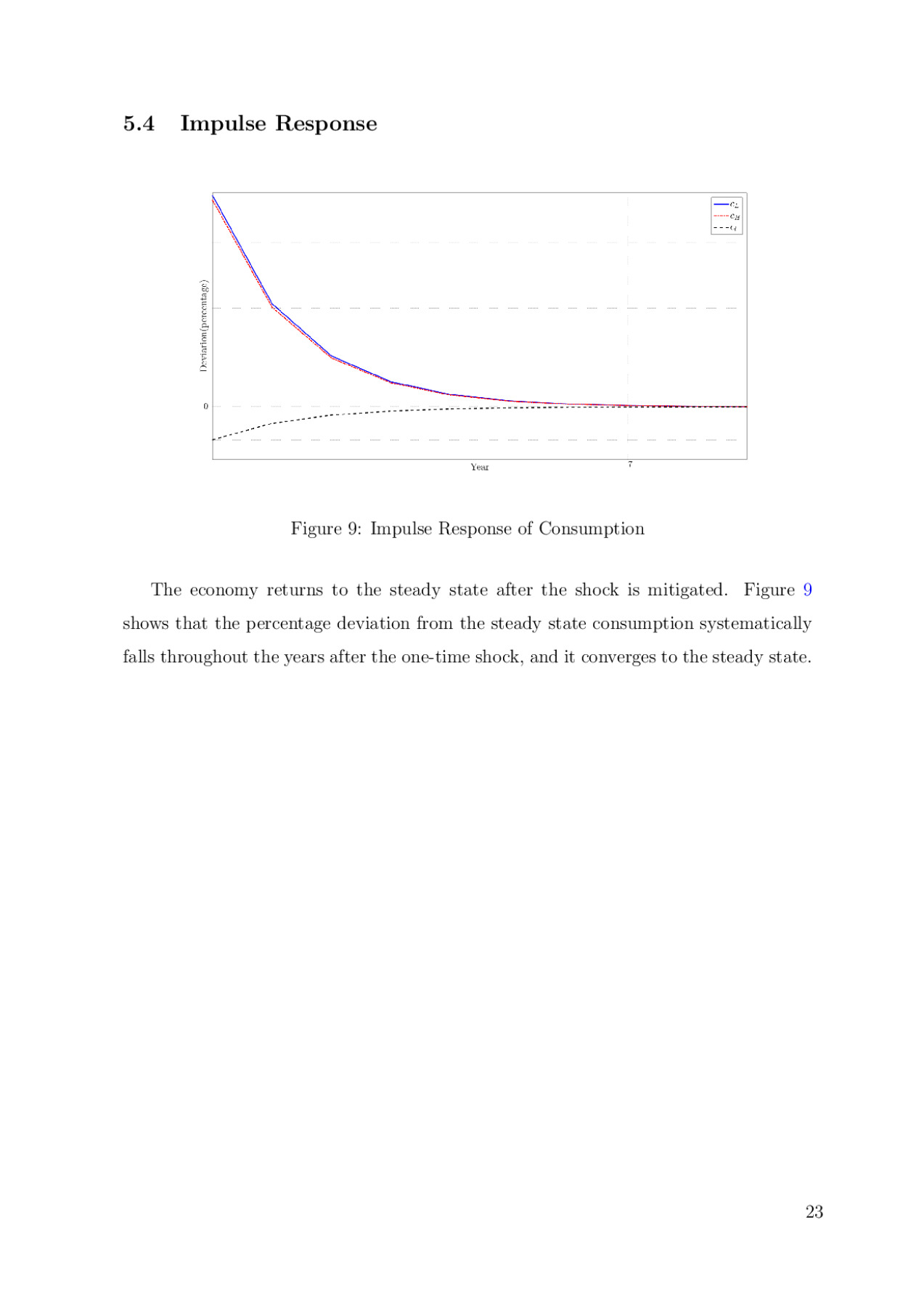

This paper evaluates the redistributive properties of a monetary policy shock in a continuous time heterogeneous agent model designed for India. In contrast to the existing literature on India that features limited heterogeneity, my model features a continuum of households indexed by the joint distribution of assets and idiosyncratic labor productivity. A number of model parameters are calibrated using numerous data sources. The steady state moments of household consumption and assets are matched with the moments from survey data to examine the reliability of the model. A one percentage point reduction in monetary policy in the span of one year leads to, on an average, 4% to 8.5% increase in household consumption, with the highest magnitude of increase observed in the households at the 25th to 75th percentile of the asset distribution.

Preview