2024 North American Winter Meeting, San Antonio, Texas: January, 2024

Asymmetric Information, Asset Markets, and the Medium of Exchange

Athanasios Geromichalos, Lucas Herrenbrueck, Zijian Wang

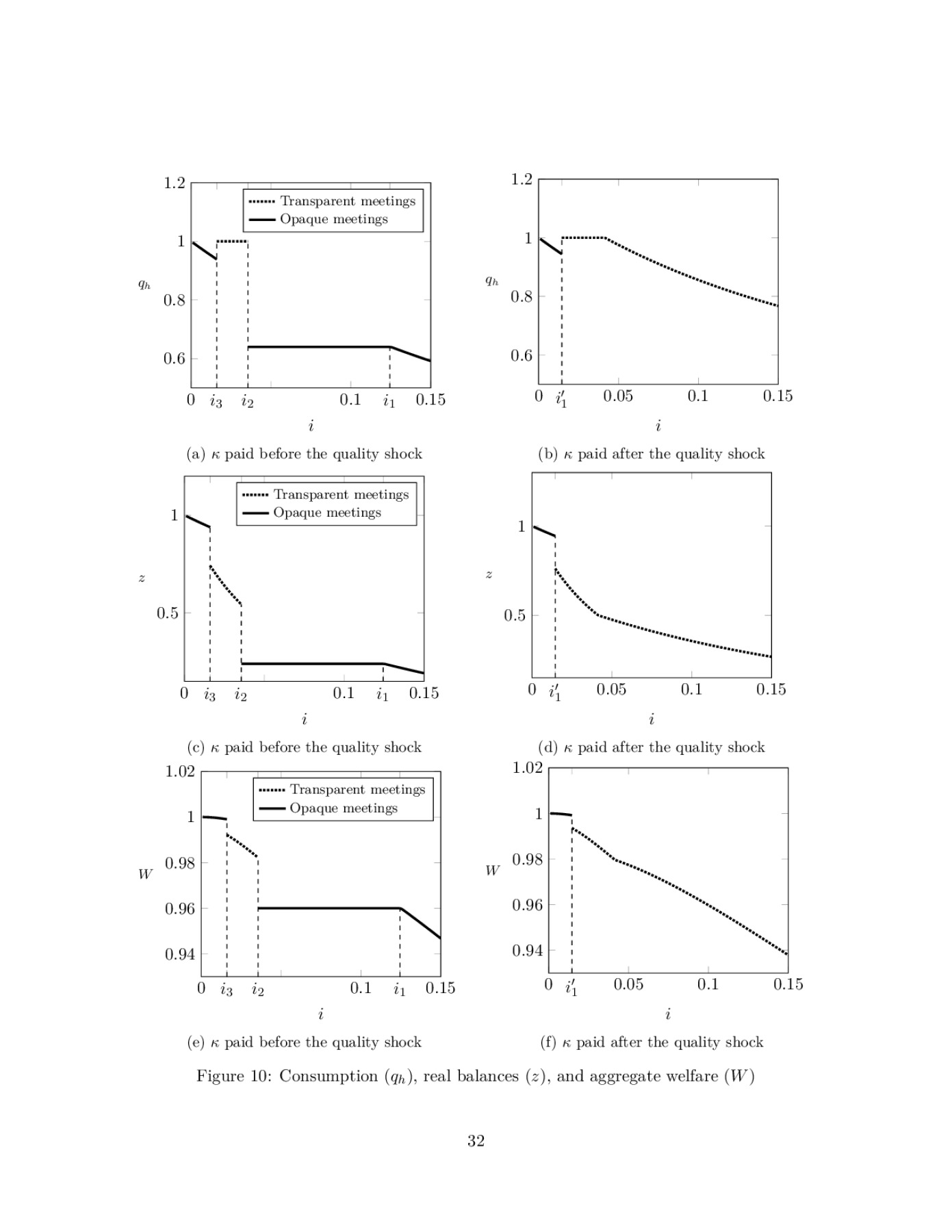

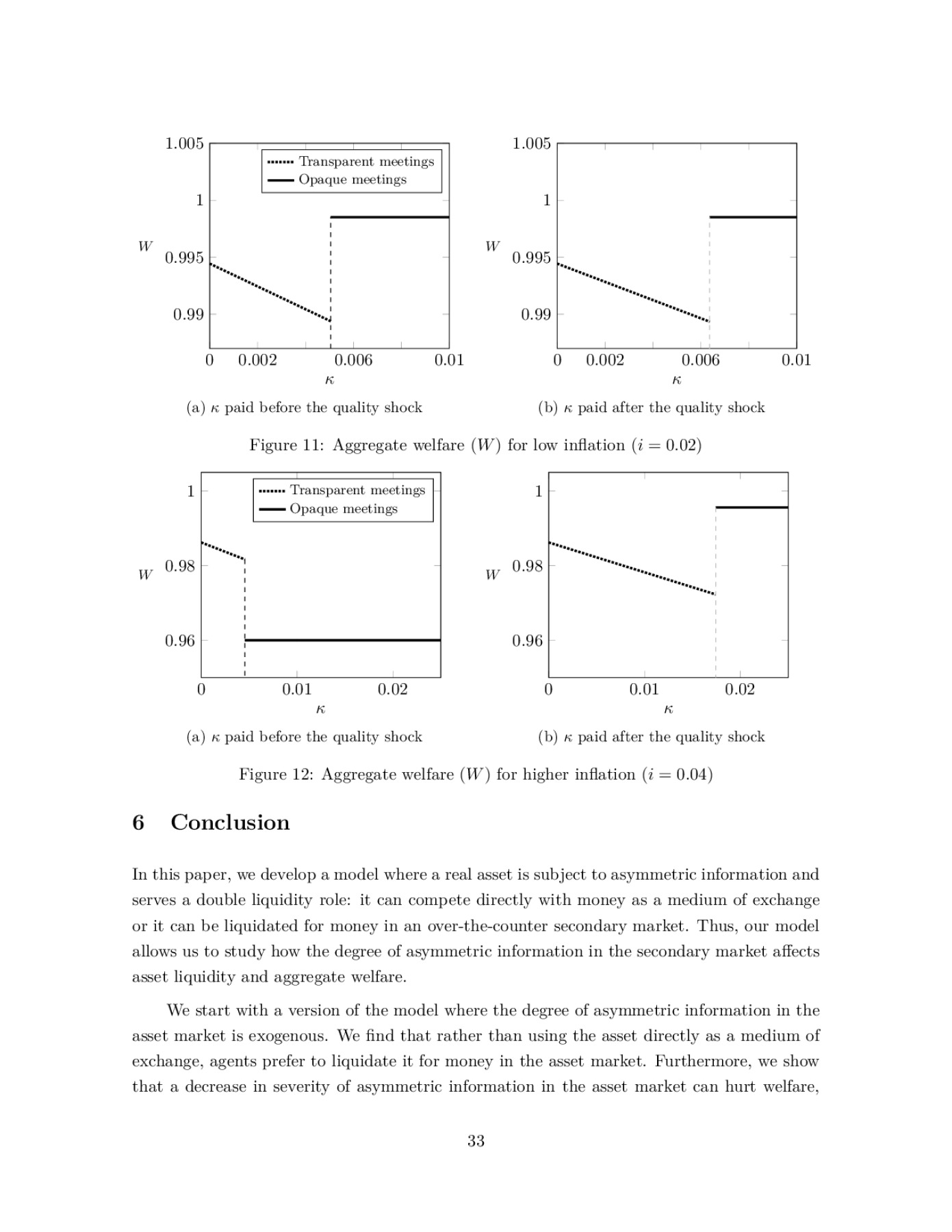

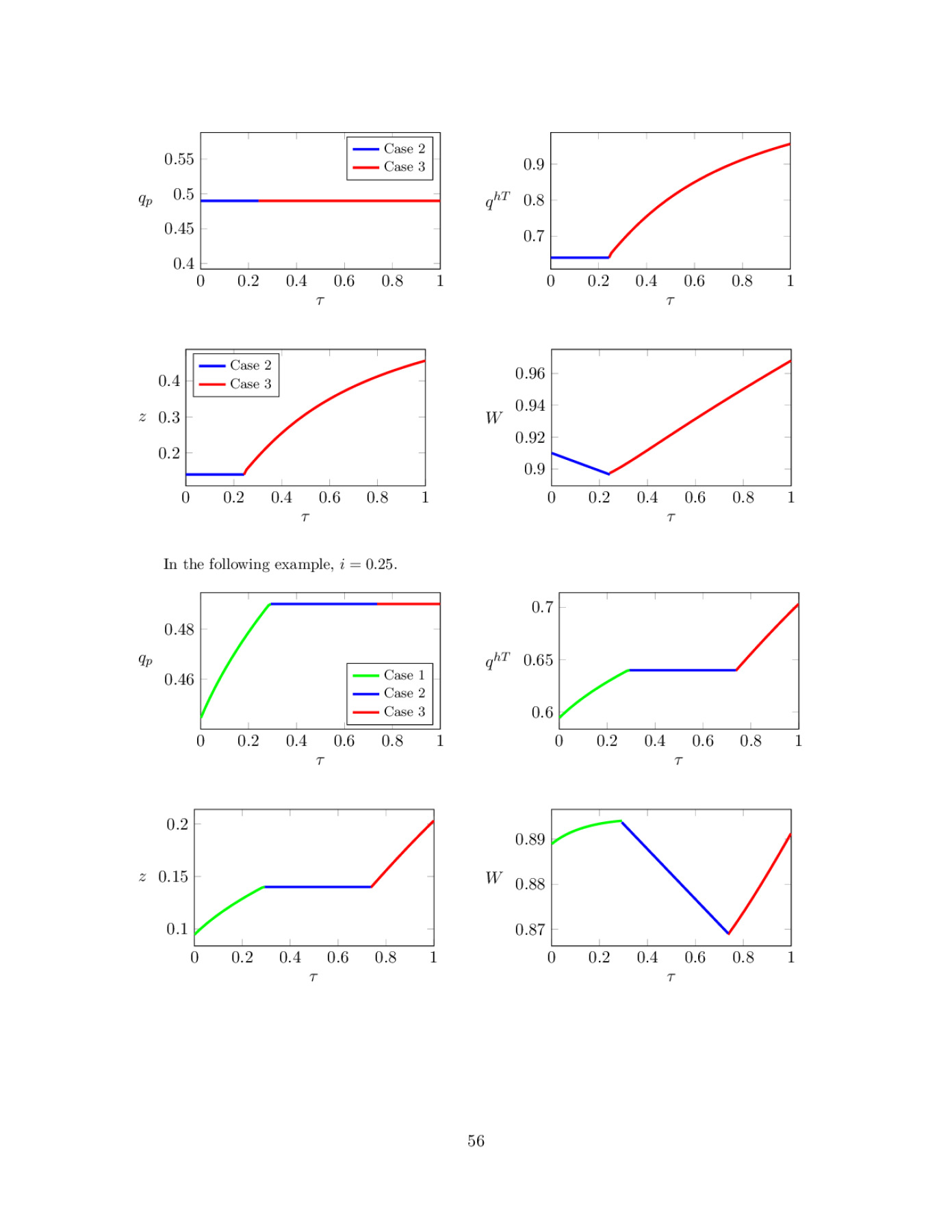

Recent work in the New Monetarist literature has studied how asymmetric information can hinder the role of assets as means of payment in decentralized markets for goods/services. The present paper revisits this important question, incorporating a crucial ingredient that has so far been overlooked: agents who wish to use assets for liquidity motives also have the option to sell these assets for money in dedicated secondary markets, where, arguably, the asymmetry of information is less severe, and subsequently use money as a medium of exchange. In this environment, agents use secondary asset market trades both for rebalancing their portfolios and as a signal of asset quality in the goods market. The model delivers a number of new economic insights. For instance, a decrease in the severity of asymmetric information in the secondary asset market can hurt welfare. We also find that inflation is crucial for the determination of key equilibrium variables, such as the volume of trade in the secondary asset market, and the decision of agents to invest in information that reduces the degree of information asymmetry.

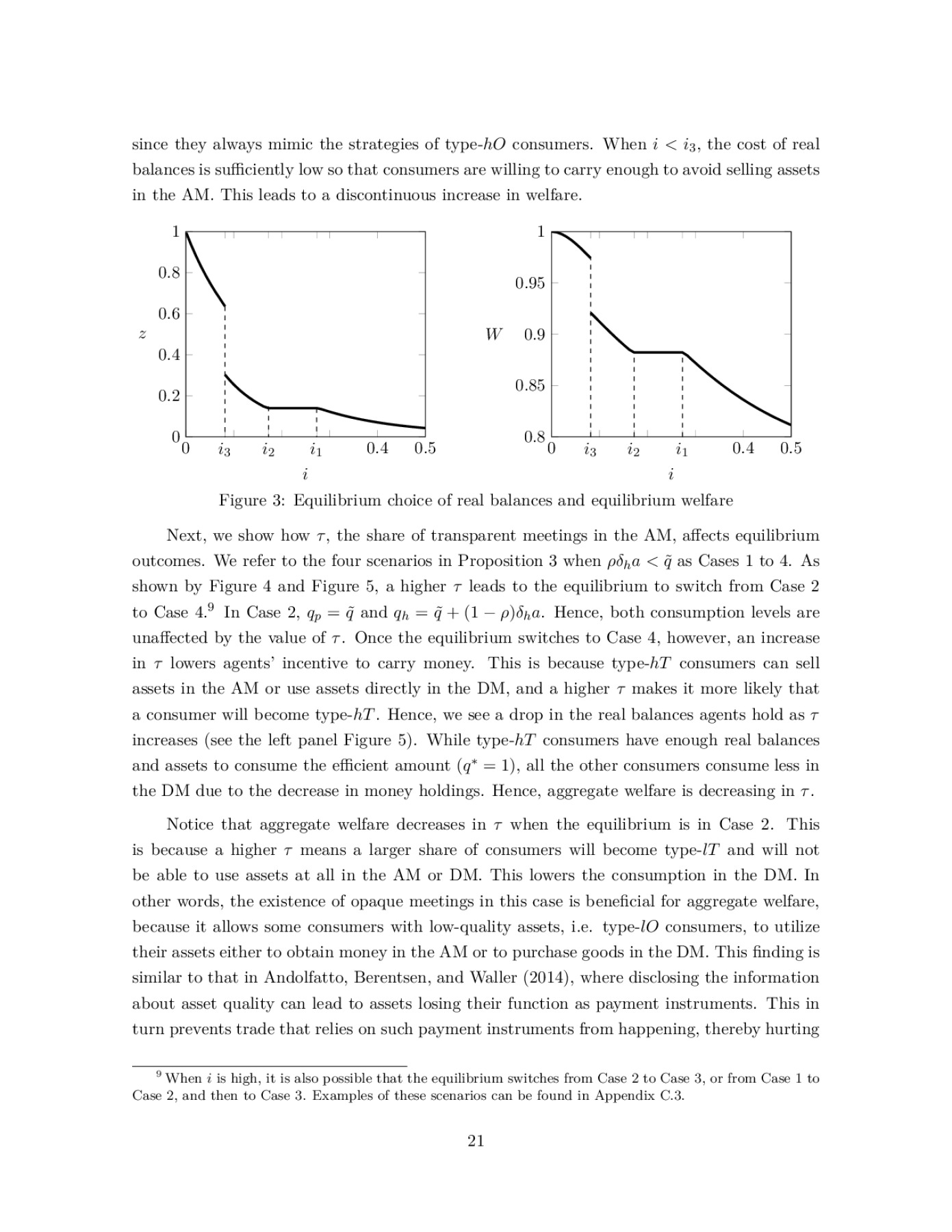

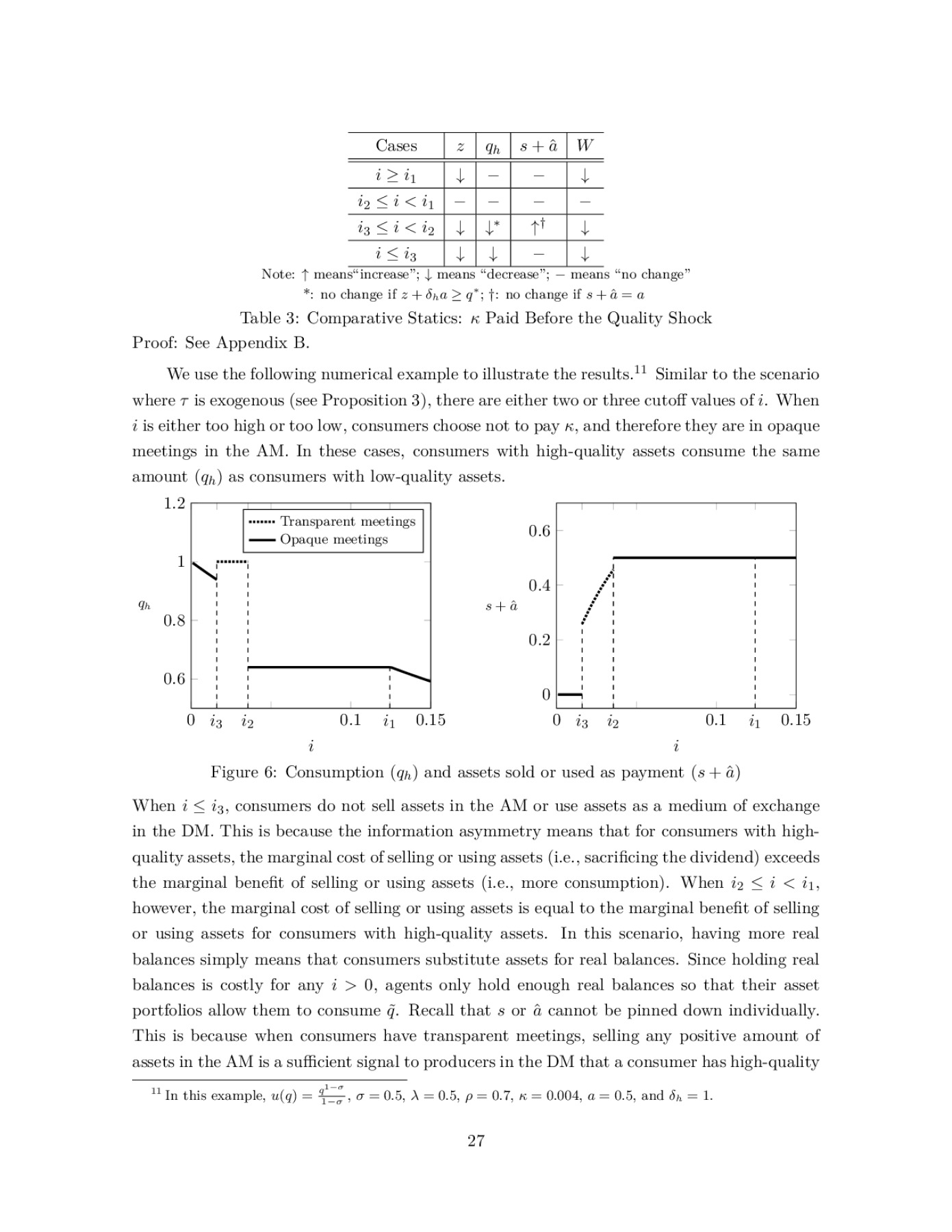

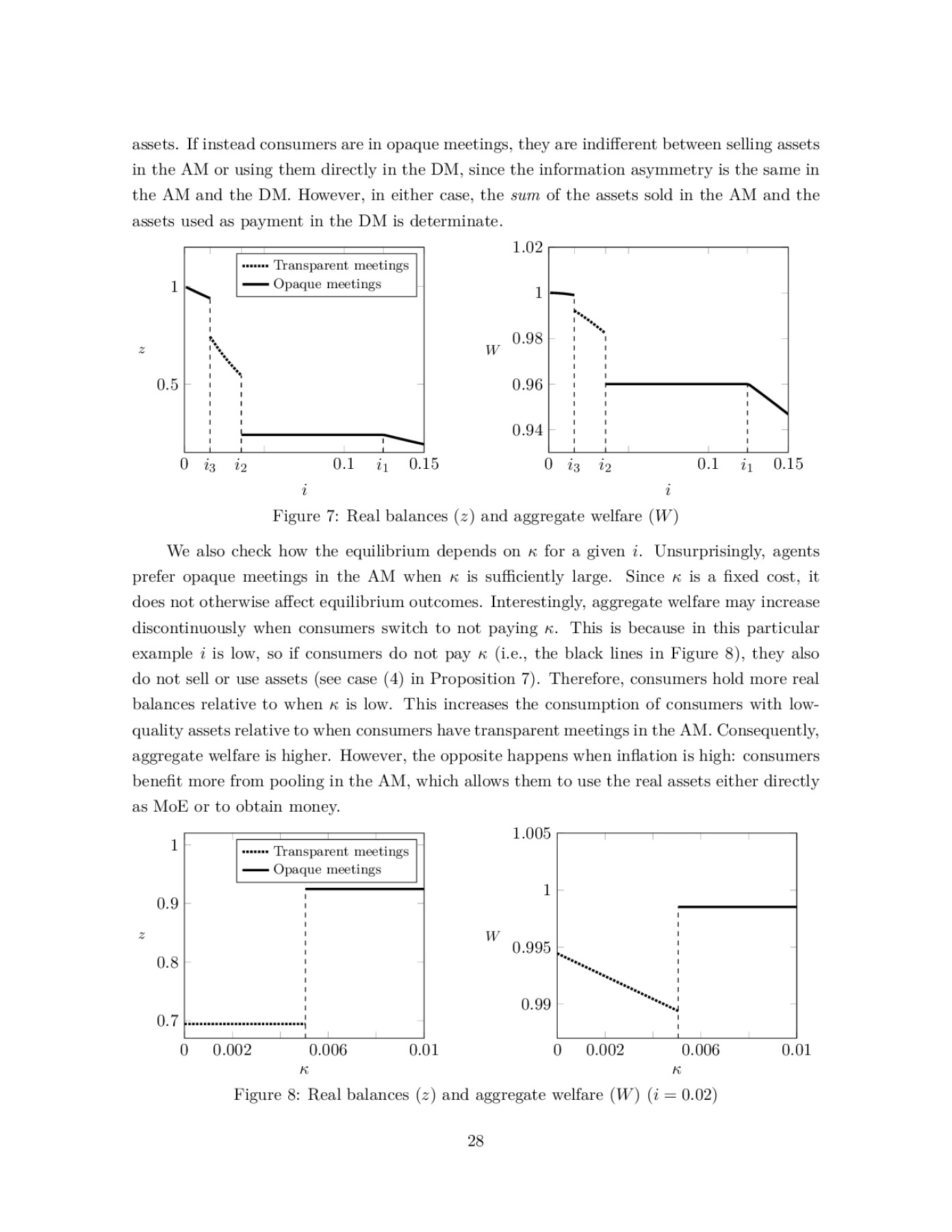

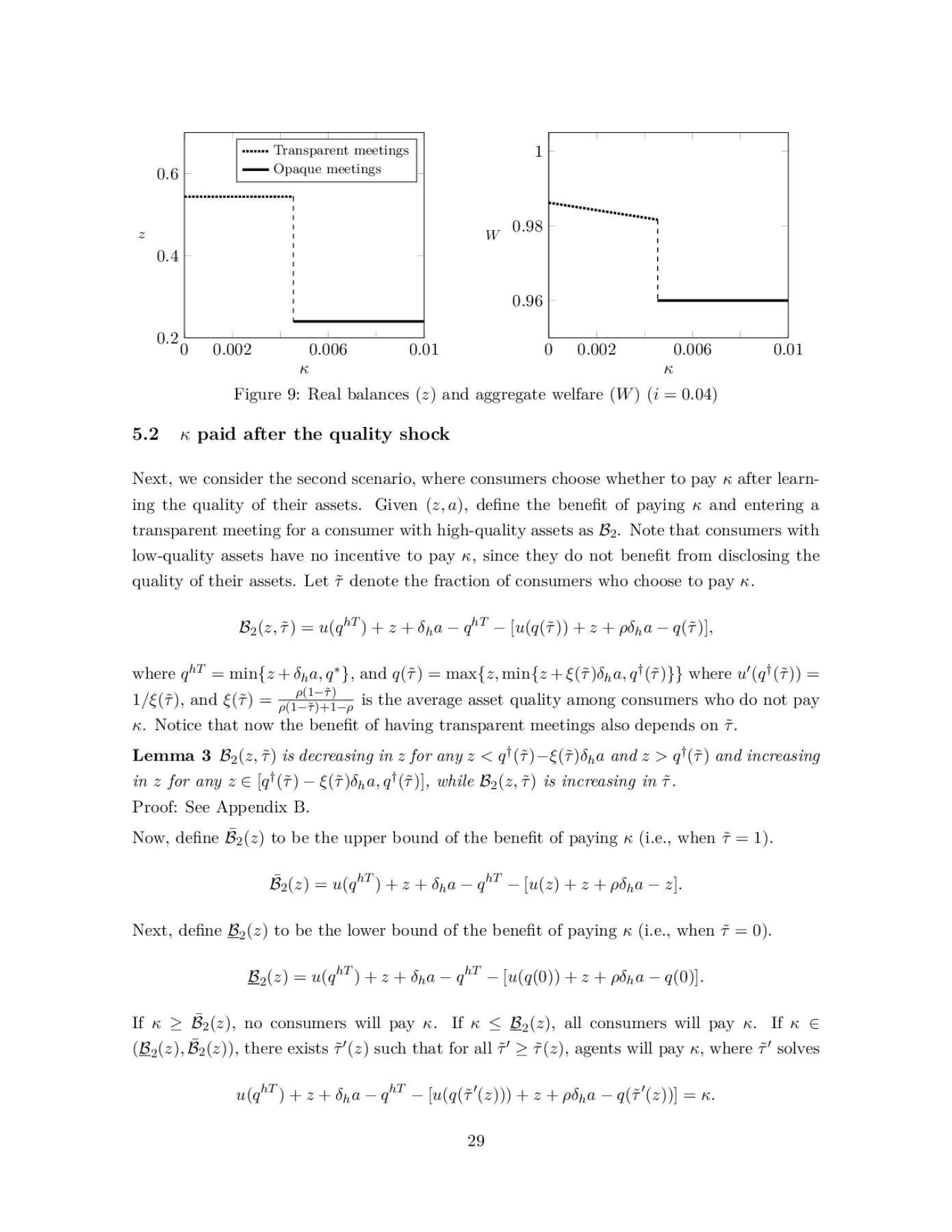

Preview